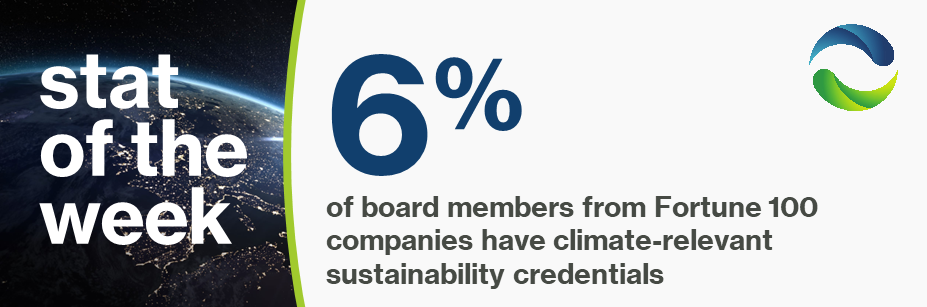

Early last year, the NYU Stern School of Business found that of the 1188 board members of Fortune 100 companies, only 29% had any ESG credentials (e.g. experience with human rights issues, ethics, cybersecurity, climate, or water issues), and most of that expertise was in social issues. Only 6% of board members had credentials related to environmental sustainability. The Stern researchers judged that only five of the 1188 board members had relevant climate experience. Combined with earlier research showing that only 10% of boards from the top 475 companies in the Fortune 2000 reviewed sustainability issues at their meetings, these findings paint a rather dismal picture of underpowered governance on climate issues.

Good boards feature a diversity of experience and perspective, and it’s not necessary that all members, or even a majority, be experts in any particular field. But it is generally helpful for boards to be well-attuned to the risks and opportunities their company faces. As my colleague Jacqueline Kessler wrote last week, climate risk and climate action are material factors that clear majorities of investors and insurers consider. As companies face mounting pressure to set emissions reductions targets, outline climate action plans, and show commitment on ESG issues, leaders must know which issues are material, how to respond strategically, and how to capture additional value from their actions. When directors lack knowledge of ESG issues and aren’t regularly reviewing the ESG plans of the companies they’re meant to oversee, boards will only hinder successful ESG management, and they will be far off from guiding strategic ESG action.

What do we do with this knowledge now? Considering – even prioritizing – ESG expertise during nomination can help strengthen top-down leadership on these issues over time, but there are also steps available to strengthen current directors’ responsibility for, awareness of, and emphasis on climate and ESG issues. Given the experience gap described above, education can go a long way. The Climate Board is proud to have helped its members’ boards to understand everything from the basics of climate science to industry-specific financial imperatives for action.

Corporate governance practices and policies also play a key role. In our work on effective ESG governance practices, The Climate Board examined how different ESG-forward companies structure their board-level review and oversight of ESG risks and strategy. Executive ESG steering committees, formalized champions for sustainability at the board level and C-suite, regular reporting through the Sustainability team to the top of the organization, and sustainability-linked compensation are all effective tools. Our research showed that ESG governance practices don’t have to be one-size-fits-all, but there are some common elements of success. The boards of companies we profiled were active participants in their ESG action plans, and accountability for climate and ESG plans ran through successful organizations at every level.

No matter what your company’s path to a climate-conscious board of directors looks like, be sure you’re on one.

Is your board pulling its weight on sustainability, or sitting on the sidelines? Are you a director who wants to learn more about how climate action fits in with core strategy? Or maybe you’re one of the lucky few leveraging your climate experience and expertise from the boardroom. No matter which, we’d love to hear your perspective. Click here to get in touch with our research team.